Introduction:

Home insurance is a big part of your overall financial plan, it provides security and peace of mind for homeowners across Canada. With natural disasters and unexpected events on the rise, Canadian homeowners are realizing the importance of full coverage home insurance. Whether you’re a first time buyer or a seasoned homeowner, navigating home insurance in Canada can be overwhelming. This guide will answer your questions, break down the options and provide you with practical tips to protect your home and your finances.

What is Home Insurance in Canada and Why Do You Need It?

Home insurance in Canada covers damage, theft or liability related to your property. Most lenders require proof of insurance when you take out a mortgage but even without a loan, insuring your home is important. Policies cover the structure, your belongings and liability if someone is injured on your property.

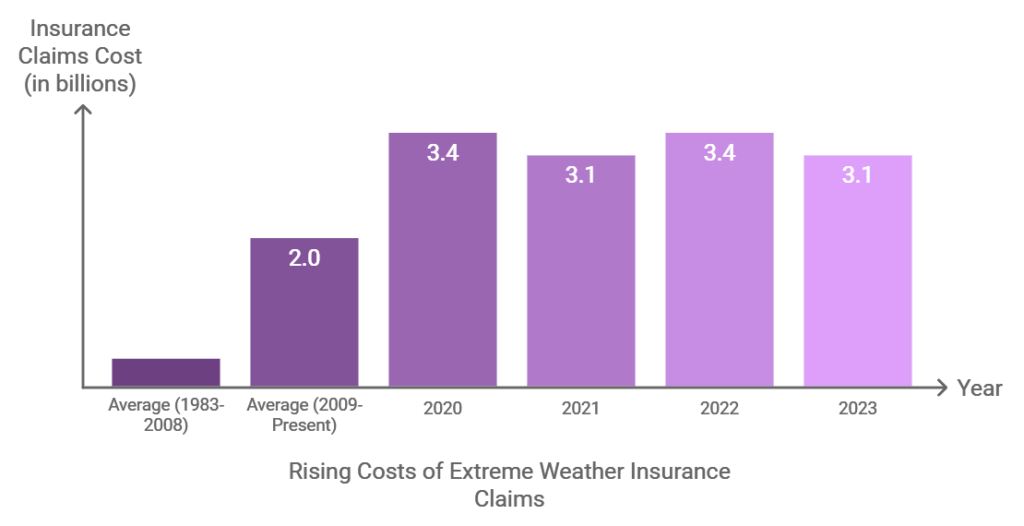

Canadian weather extremes, from winter storms to summer wildfires, are a reminder to have a solid home insurance policy that can withstand any emergency. Home insurance not only protects the physical structure of your home but also covers additional living expenses if you need temporary housing.

Advertisement

Types of Home Insurance Policies in Canada

In Canada there are three main types of home insurance policies:

Comprehensive or All-Risk Policy

This is the most comprehensive and most expensive option. It covers your home and personal belongings for most types of damage and loss except for what’s excluded in the policy.

Basic or Named Perils Policy

A budget friendly option, this policy only covers the perils listed, such as fire, theft or certain natural disasters. While affordable it may leave gaps especially in areas with frequent extreme weather.

Broad or Hybrid Policy

This covers the building on an all-risk basis but for personal belongings it limits coverage to named perils. A middle of the road option for those who want some comprehensive coverage without the cost of full comprehensive.

How Much Does Home Insurance Cost in Canada?

Home insurance in Canada can cost a lot depending on where you live, what type of property you have and how much coverage you have. On average Canadians pay between $800 and $1,500 a year for home insurance. Urban areas with higher crime rates or areas prone to natural disasters will cost more.

For example, someone living in BC where wildfires are a big risk will pay more than someone in an area with less natural disasters. Insurance companies also take into account home size, age, construction type and any safety features installed.

What Affects Your Home Insurance Premiums?

Location:

Areas with a higher risk of claims (floods, wildfires etc) means higher premiums.

Home Features:

Home size, construction type and safety features affect your premium.

Claims History:

If you have had previous claims, insurers may consider you a higher risk and increase your premium.

Credit Score:

Some insurers use your credit score when calculating your premium as it shows financial responsibility.

Coverage and Deductibles:

Higher coverage limits or lower deductibles means higher premium, higher deductibles means lower premium.

Advertisement

FAQs About Home Insurance in Canada

1. Is Home Insurance Mandatory in Canada?

No, home insurance is not mandatory in Canada. But most mortgage lenders require proof of insurance to protect their investment. Even without a mortgage it’s a good idea to insure your home to avoid financial setbacks due to unexpected events.

2. Does Home Insurance Cover Flooding?

Standard home insurance in Canada does not cover overland flooding. But many insurers offer flood coverage as an add-on. This is especially important if you live near water or in areas that get heavy rain.

3. What is “Replacement Cost” in Home Insurance?

Replacement cost means the amount needed to repair or rebuild your home to its original state using the same materials, regardless of the current market value. So in the event of total loss your property can be restored without out of pocket costs.

4. Are Earthquakes Covered Under Home Insurance?

Earthquake coverage is not included in standard policies but can be added as an endorsement. In areas like BC and Quebec where seismic activity is higher, it’s recommended to add earthquake insurance.

5. How Can I Lower My Home Insurance Premium?

There are several ways to do so. Installing security systems, smoke detectors and fire alarms will get you discounts. Bundling home and auto insurance, higher deductibles and a clean claims history will also help lower your insurance costs.

Coverage

When choosing your coverage make sure to get an accurate value of your home and contents. Many Canadians underestimate how much it would cost to rebuild or replace items after a loss. Doing an inventory and estimating rebuild costs will prevent financial stress if a disaster happens.

Also review and update your policy annually. As your home and possessions increase in value so should your coverage. And make sure to read and understand policy exclusions. Coverage for specific events like sewer backups or overland flooding may require separate endorsements or add-ons.

How to Choose the Best Home Insurance

1. Get to Know Your Needs:

Location and Risks:

Think about local risks like flooding or earthquakes. Some areas may require additional coverage like overland water insurance.

Valuables:

If you have high value items like jewelry or art make sure your policy limits are sufficient or consider additional riders.

2. Shop Around:

Use online comparison tools or talk to a broker to get quotes from multiple insurers. Prices can be very different for the same coverage.

Deductibles:

Higher deductibles will lower your premium but increase out-of-pocket costs if you make a claim.

Exclusions:

Know what’s not covered. For example most policies exclude overland flooding unless added.

Advertisement

4. Look for Discounts:

Bundling:

Combining home with auto or other insurance types will reduce costs.

Security

Systems: Having monitored alarms or other security features will give you a discount.

Loyalty:

Long time customer with an insurer may get loyalty discounts.

5. Check Company Reputation:

Read customer reviews and independent ratings. High customer satisfaction means better service during claims.

6. Add-ons:

7. Review Annually:

Home insurance is not a set-and-forget product. Review your coverage annually for changes in home value, renovations or changes in home contents.

8. Credit Score:

In many provinces your credit score can impact your insurance rates. Keep or improve your credit score to lower your premiums.

9. Know Your Needs:

Don’t go for the cheapest. Make sure it covers what you need. For example if you run a business from home standard policies may not be enough.

10. Get Expert Advice:

An independent insurance broker can give you personalized advice and help you navigate the complexity of insurance options.

Bottom Line

Home insurance in Canada is more than just a monthly payment—it’s a lifeline in times of need. Now that you know the types of policies, coverage options and cost factors you can make informed decisions to protect your home, contents and loved ones. Remember a policy tailored to your unique needs will give you peace of mind and financial security no matter what life throws your way.

External Resources for Home Insurance in Canada

Insurance Bureau of Canada (IBC)

IBC has info on home insurance in Canada, including natural disaster coverage and consumer rights.

Financial Consumer Agency of Canada (FCAC)

This government agency has unbiased info on financial products, including home insurance policies, deductibles and premiums.

Canada Mortgage and Housing Corporation (CMHC)

CMHC has info for homeowners on home insurance, including how it affects property value and home maintenance responsibilities.