Start Here

In Canada, insurance is a big part of financial security – from your home and health to vehicle liabilities. With so many options, choosing the right type for you can be tough. New to insurance or looking to switch providers? This guide will help you make an informed decision with real advice and tips. Let’s get started choosing the right policy for you in Canada.

Advertisement

What to look at

It’s not just about the price – it’s about the value and peace of mind. Here are the basics:

1. Know Your Needs and Risks

Every person and family are unique. Are you looking to protect a mortgage, your family’s health or your vehicle? Identifying the areas you need coverage in (life, home, auto or health) is the first step. If you have a family history of certain illnesses or if you live in a high-risk area for natural disasters, you may need more coverage in those areas.

2. What Types of Insurance are Available in Canada

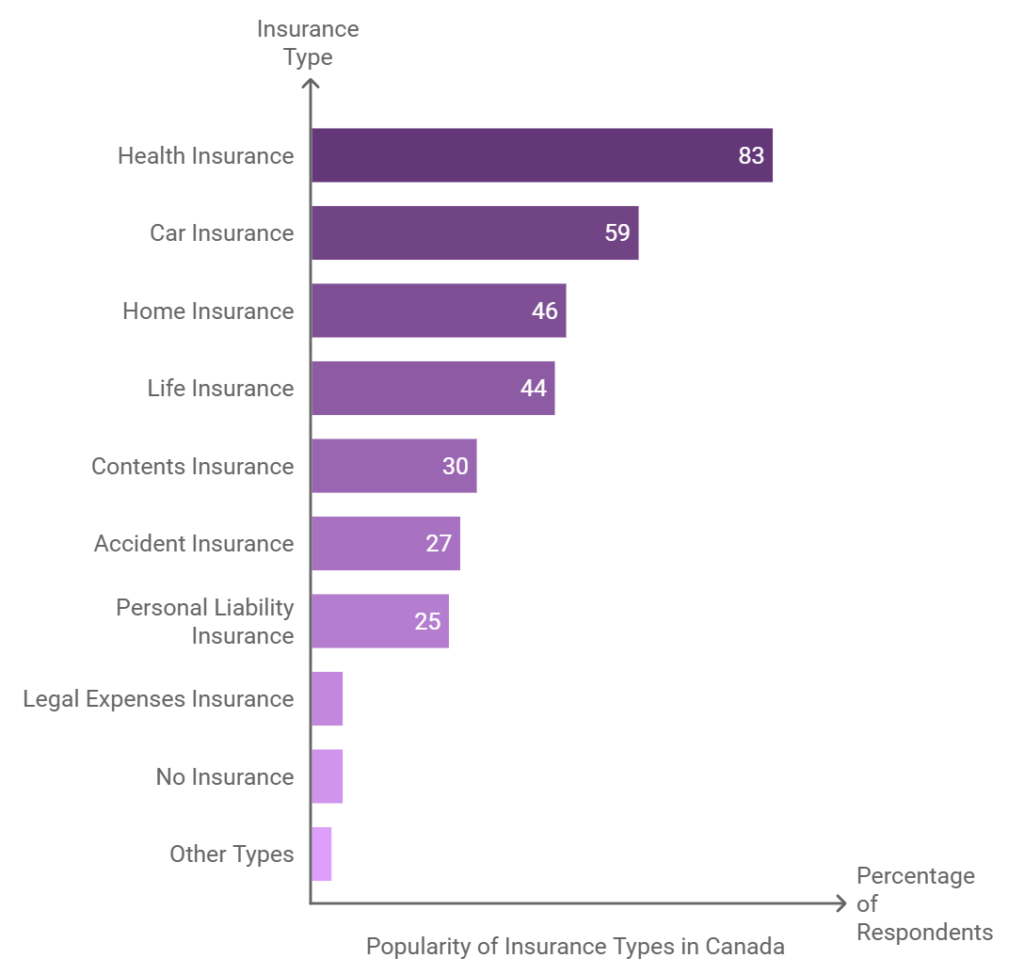

Canadians have many options. Here are some of the main ones:

- Life Insurance: Term and whole life for long term financial security.

- Health Insurance: Covers medical expenses not covered by provincial healthcare.

- Auto Insurance: Mandatory in Canada; covers liabilities and depending on your plan can cover damage to your vehicle.

- Home Insurance: Covers home related losses including theft and natural disasters.

3. Compare

Now that you know what you need, compare quotes from multiple providers. Sites like Ratehub.ca or InsuranceHotline.com let you compare policies and rates from Canadian insurers. Make sure to compare not only the monthly premium but also the deductible, co-payment and exclusions.

Advertisement

Questions to Ask When Choosing a The Right Policy

1. What is Covered?

Read the fine print to know what’s covered and just as importantly what’s not. Some policies might seem cheap but lack critical coverage options like natural disaster coverage in home insurance or dental coverage in health insurance. Make sure the policy covers what you need.

2. How Much is the Premium and Deductible?

The premium is what you pay regularly (monthly or annually) and the deductible is what you pay out of pocket when you file a claim. Balancing these two is key; a lower premium might mean a higher deductible which could hurt you financially during emergencies.

3. What are the Policy Limits?

Most policies have limits that cap what the insurer will pay for a covered claim. For example auto insurance may have limits on liability or collision coverage and health insurance may have annual claim limits. Make sure these limits meet your needs.

4. How Good is the Insurer?

The provider matters. Choose an insurer with a good reputation for customer service, claims processing and financial stability. Organizations like J.D. Power rate Canadian insurers so you can get a better sense of an insurer’s reliability.

How to Choose the Right Policy

1. Balance Cost and Coverage

It’s easy to go for the cheapest policy but low-cost policies often come with limitations. Aim for a policy that balances affordability with comprehensive coverage. For example, while health policy with a high deductible may lower your premium, think about how that will affect you if you have unexpected medical expenses.

2. Bundle Your Policies

Many insurers in Canada offer discounts for bundling multiple types of coverage like home and auto policies. Bundling can simplify your payments and give you a discount – up to 15% in some cases. Check if your insurer offers this and if it fits your overall needs.

3. Consider Inflation and Increasing Costs

Inflation affects everything. Over time the cost of replacing a car or home or medical bills increases. Some insurers offer policies that automatically adjust for inflation so your coverage keeps up with the cost of living.

4. Look for Extra Benefits and Riders

Riders or add-ons can add to your coverage. For example a critical illness rider on a life policy can give you a lump sum if you’re diagnosed with a serious illness. Check these out to make sure your policy is as comprehensive as possible for your needs.

5. Get Advice

Talk to an independent broker or financial advisor. They can help you out.

Advertisement

FAQs About Insurance in Canada

Q1: What’s the difference between term and whole life insurance?

A1: Term covers you for a set period (e.g. 20 years) at a lower cost. Whole life insurance covers you for life and has a cash value component so it’s more expensive but longer term.

Q2: Do I need health policy if I have provincial coverage?

A2: Yes. Provincial coverage doesn’t cover everything. Extended health insurance covers dental, vision and prescription drugs—expenses that are often only partially covered by provincial plans.

Q3: Are there tax benefits to having insurance in Canada?

A3: Yes. Some policies, like life insurance, have tax advantages as the death benefit is often tax free to beneficiaries. Certain health insurance premiums may also be tax deductible if they exceed a certain amount.

Q4: What does “no-fault” mean in auto insurance?

A4: No-fault insurance, used in some provinces, means your insurer will pay for your damages regardless of who was at fault. This streamlines the claims process but doesn’t absolve the responsible party of liability.

Bottom Line

Choosing the right insurance in Canada isn’t easy but by knowing what you need, comparing options and asking the right questions you can get coverage that gives you real peace of mind. Take the time to research and when in doubt seek advice from a pro who can walk you through it. Remember, the right insurance isn’t just about price—it’s about your future.

Advertisement