Introduction

As a solopreneur you have the freedom to build your career, but it comes with unique challenges—health insurance being one of the biggest. Without employer sponsored plans, finding affordable comprehensive health coverage can feel like a nightmare. This Self Employed health insurance guide will walk you through the basics of getting a policy that fits your needs, with tips, FAQs and strategies to help you make informed decisions.

Why Health Insurance Matters

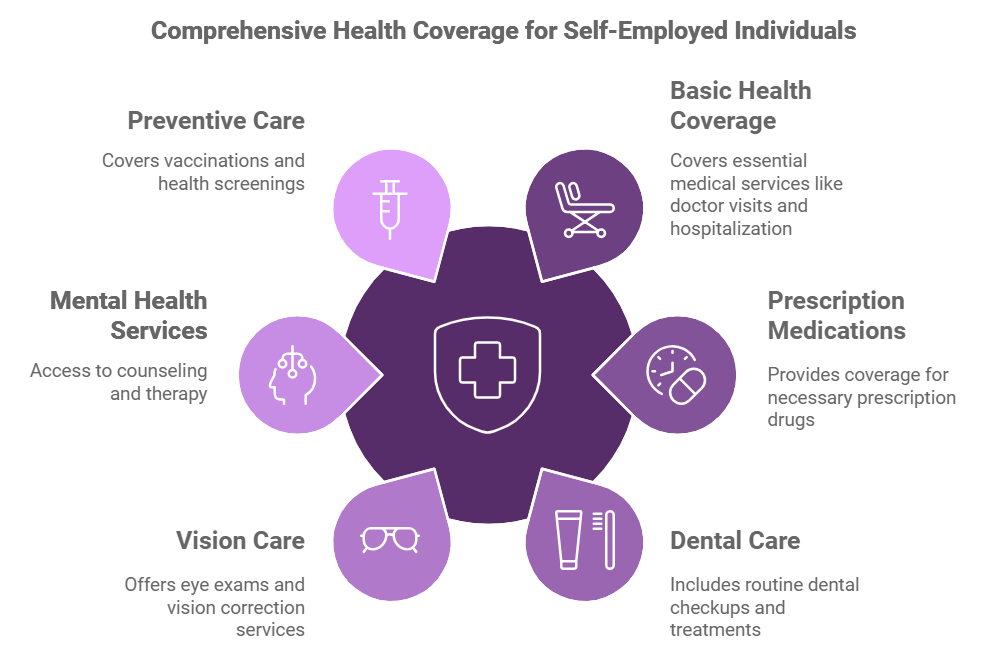

It’s not just an expense, it’s a safety net. Medical emergencies can bankrupt solopreneurs without group benefits. A good plan will:

- Financial Protection: Covers unexpected medical bills.

- Preventative Care: Regular check-ups for early detection and wellness.

- Tax Savings: Many premiums are tax deductible.

Advertisement

Self Employed Health Insurance FAQs

1. What are my choices?

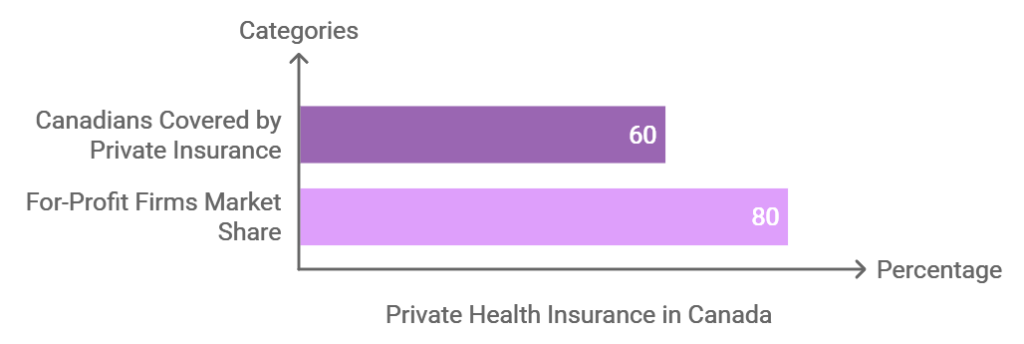

- Private Plans: Blue Cross and Sun Life plans.

- Professional Associations: Group plans for trade organization members.

- Spousal Coverage: If possible, join your spouse’s employer plan.

- Health Savings Accounts (HSAs): Tax-advantaged savings for medical expenses (U.S. only).

2. How do I choose?

- Assess: Your medical history, dependents, financial situation.

- Compare: Coverage, exclusions, reviews.

- Calculate Costs: Look at premiums, deductibles, co-pays.

3. Are premiums tax deductible?

- In many countries including the U.S. and Canada, health insurance for self employed is tax deductible, reducing your taxable income. Always check with a tax advisor for details.

4. What about pre-existing conditions?

- Some insurers offer guaranteed acceptance plans which don’t require medical questionnaires. But premiums will be higher.

5. Can I get group insurance as a freelancer?

- Yes, many professional organizations and industry groups offer group plans. Examples include chambers of commerce and trade unions.

Advertisement

7 Ways to Get the Best Health Insurance as a Self-Employed Pro

1. Research Providers

Manulife, Desjardins and GreenShield have plans for freelancers. Check out their features (critical illness, dental, mental health etc.)

2. Use Online Marketplaces

PolicyAdvisor (Canada) or Healthcare.gov (U.S.) let you compare plans, check for subsidies and buy online.

3. Bundle for Savings

Many insurers offer discounts when you bundle health insurance with other policies (life or disability insurance)

4. HSAs or FSAs

If available, use these to save pre-tax for medical expenses and reduce overall cost.

5. Join Professional Associations

Memberships often have group plans at a lower cost than individual policies.

6. Catastrophic Coverage

If budget is tight, catastrophic plans have lower premiums and cover major medical events.

7. Review Every Year

Insurance needs change. Review your policy annually to make sure it still fits your needs and budget.

Advertisement

Secret Ways to Save

- Shop During Open Enrollment

Make sure you’re shopping all options during your country’s open enrollment period for better rates and subsidies. - Negotiate with Providers

Some insurers offer discounts if you pay annually or maintain a healthy lifestyle. - Telehealth Options

Plans with telehealth services can reduce consultation costs and give you 24/7 access to doctors. - High-Deductible Plans

If you’re healthy and don’t plan to visit your doctor often, a high-deductible plan with lower premiums might be for you. - Subsidies

Look for programs that will help lower your monthly premiums.

Done

Health insurance is an investment for every self-employed pro. Know your options, compare providers and use tax benefits to get a plan that gives you peace of mind and financial security. Start now!