Introduction

Travel is one of the greatest joys of life, new experiences, new cultures, new memories. For Canadians, traveling comes with special responsibilities, including having to have travel insurance. Unexpected events like medical emergencies, trip cancellations or lost luggage can turn your dream vacation into a financial disaster. That’s why having the right travel insurance is key to protecting your investment and peace of mind.

This guide will answer all your travel insurance questions and give you actionable tips to choose the best coverage. Whether you’re a seasoned traveler or a once in a lifetime trip, this will give you the knowledge to make informed decisions.

Advertisement

Why Do Canadians Need Travel Insurance?

Travel insurance is a safety net for unexpected events that can happen during your trip. Here’s why:

- Provincial Health Coverage Limits: Provincial health plans don’t cover 100% of medical expenses abroad. A hospital stay in the U.S. for example can cost over $10,000 per day.

- Trip Cancellations: Sudden emergencies or natural disasters can force you to cancel your plans. Travel insurance will reimburse non-refundable expenses.

- Lost or Delayed Luggage: Airlines misplace 6 bags per 1,000 passengers globally. Insurance can compensate for lost items and delayed baggage essentials.

- Peace of Mind: Knowing you’re covered so you can enjoy your trip.

Know What you are Applying for Travel Insurance

When buying travel insurance, you need to know what you need and understand the policies you’re looking at. Are you looking for medical only cover? Do you want trip interruption or reimbursement for lost or delayed luggage? Each of these scenarios involves unexpected expenses but the financial impact can be very different.

For example, delayed baggage might only be a few hundred dollars, some people might feel comfortable paying that out of pocket. But an unexpected medical emergency overseas can result in eye watering bills – I’ve seen a claim for $130,000. Few people are willing to take on that level of risk.

Don’t get caught out, make sure you know what you’ve chosen. If you get it wrong, you’ll be paying for things you thought were covered.

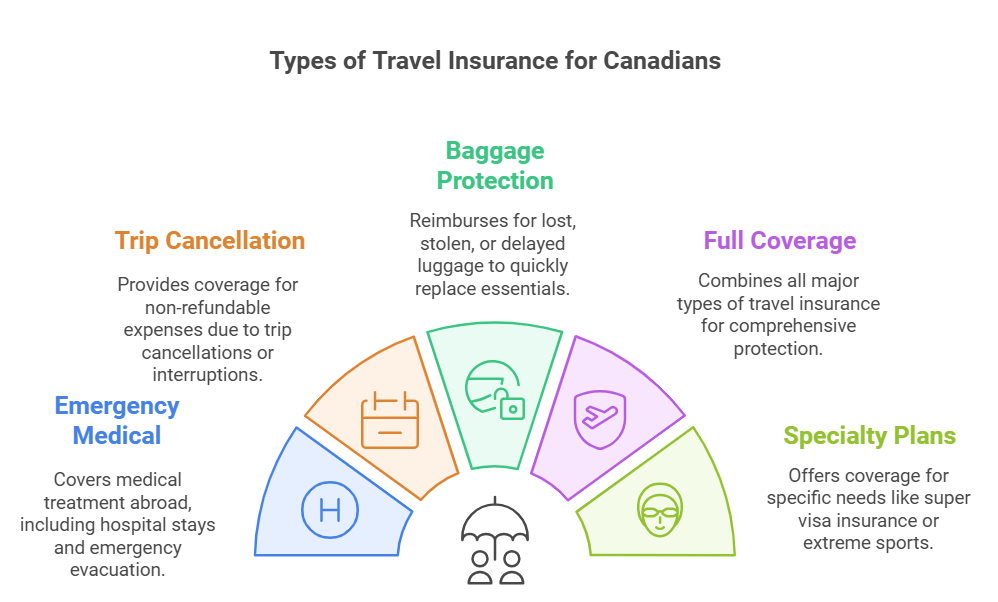

Types of Travel Insurance for Canadians

1. Emergency Medical

Covers you for medical treatment abroad, hospital stays, doctor’s visits, prescription medications. Some policies also cover emergency evacuation.

2. Trip Cancellation and Interruption

Covers non-refundable expenses if you have to cancel or cut your trip short due to illness, weather disruptions or other unexpected events.

3. Baggage Loss, Theft or Delay

Reimburses for lost, stolen or delayed luggage so you can get essentials back quickly.

4. Full Coverage Plans

Combines all major types of travel insurance for total protection.

5. Specialty Plans

Covers specific needs like super visa insurance for family members visiting Canada or insurance for extreme sports.

Advertisement

Travel Insurance FAQs

1. What is covered?

- Emergency medical

- Trip cancellations or interruptions

- Lost or delayed baggage

- Accidental death and dismemberment

- Emergency evacuations

2. How much does it cost?

- Destination

- Trip length

- Age of traveler

- Coverage limits

Typically 4-10% of your trip cost.

3. Can pre-existing medical conditions be covered?

Yes, some plans cover stable pre-existing conditions. Just disclose them to avoid claim denials.

4. What are common exclusions?

- High-risk activities (e.g. skydiving, scuba diving)

- Pre-existing conditions not declared

- Non-emergency treatments

- Mental health issues

- Pregnancy related complications

How to choose the best plan

1. Get to know your needs

- Domestic or international?

- High-risk activities?

- Family members to be covered?

2. Compare

Use online comparison tools to compare multiple insurers. Check customer reviews and claim settlement ratios.

3. Read the fine print

Read the policy terms to know exclusions, coverage limits and claims process.

4. Multi-Trip Plans

Frequent travelers can save with annual multi-trip insurance.

Advertisement

Pro Tips

- Buy Early: Purchase insurance as soon as you book your trip to get cancellation coverage.

- Keep it Handy: Save your policy number and emergency contact details.

- Document Everything: Keep receipts and take photos for baggage claims.

- Use Credit Card Perks: Some premium credit cards offer free travel insurance.

- Know Your Rights: Know your policy limits to avoid disputes.

Where to Buy Travel Insurance

Finding the best place to buy travel insurance in Canada is key to a safe and stress free trip. Here are some of the top providers and tools, including World Nomads and Travelex Insurance, for different types of travel:

1. Insurance Providers for Travel Insurance

- Manulife Travel Insurance: Single trip, multi trip and all-inclusive policies with strong emergency medical coverage.

- Blue Cross: Affordable, customizable plans with medical and trip cancellation options.

- Allianz Global Assistance: Global leader in travel insurance, with emergency medical, trip interruption and baggage coverage.

2. Online Comparison Tools

- PolicyAdvisor: Compares policies across providers, with transparency and customization for your plan.

- Kanetix: Quick and easy way to compare travel insurance options with instant quotes and flexibility.

- CompareTravelInsurance.ca: Specializes in comparing rates and features from top providers in Canada.

3. Adventure and International Travel Coverage

- World Nomads: For adventure travelers. Coverage includes trekking, scuba diving, snow sports and robust medical and emergency evacuation. Explore World Nomads.

4. Coverage for All Travelers

- Travelex Insurance: User friendly approach, Travelex offers customizable travel insurance plans for families and solo travelers. Coverage includes trip cancellation, emergency medical and baggage protection. Learn more at Travelex Insurance.

5. Credit Card Benefits

Premium credit cards like Visa, Mastercard or American Express often include travel insurance as a benefit. Coverage may include emergency medical, trip interruption and lost baggage but be sure to check the terms and limits.

6. Super Visa and Specialty Insurance

For Super Visa insurance Tugo and GMS Insurance are good options for visitors to Canada.

7. Local Insurance Brokers

Consulting a local insurance broker can be helpful if you prefer personalized advice. Brokers have access to multiple policies and can recommend the best options based on your needs.

Tips for Choosing Travel Insurance

- Compare with World Nomads, Travelex Insurance and PolicyAdvisor to find your best fit.

- Check exclusions and make sure coverage for pre-existing conditions, adventure activities or destination specific risks.

- Choose providers with a hassle-free claims process and great customer reviews.

Use Travelex Insurance, World Nomads and PolicyAdvisor to get the coverage that matches your travel plans whether you’re traveling locally or globally.

Bottomline

Travel insurance is more than a policy, it’s your safety net to travel the world fearlessly. By knowing the types of coverage and your needs, you can choose a plan that makes your adventures stress free. Remember, the right travel insurance isn’t an expense, it’s an investment in your peace of mind.