Introduction

Life insurance provides financial security for loved ones in the face of tragedy, but myths and misunderstandings about why claims are denied can cause unnecessary stress. In Canada, life insurance payouts are denied for specific reasons outlined in policies. To ensure you’re fully informed, this guide dives into common scenarios where claims might be rejected, clarifies misconceptions, and offers actionable tips to avoid pitfalls.

Why Understanding Policy Denials Matters

Life insurance offers peace of mind, but confusion about claim rejections can lead to financial hardship. While over 98% of life insurance claims in Canada are paid according to CLHIA, certain avoidable mistakes or exclusions could jeopardize payouts.

Advertisement

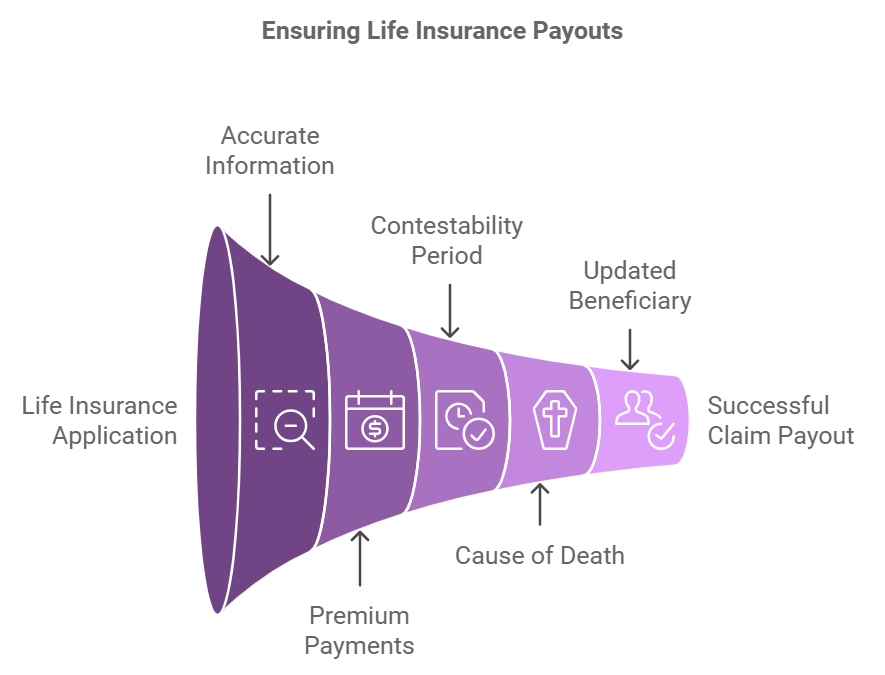

Common Reasons a Life Insurance Policy Won’t Pay Out

1. Misrepresentation or Fraud

- What It Means: Providing false or incomplete information during the application process.

- Examples: Omitting a smoking habit or failing to disclose a chronic illness.

- How to Avoid: Be honest and thorough when completing applications.

2. Non-Payment of Premiums

- What It Means: Letting the policy lapse due to missed payments.

- How to Avoid: Set up automatic payments or calendar reminders to stay on track.

3. Contestability Period Issues

- What It Means: Policies are often reviewed if the insured dies within two years of issuance.

- How to Avoid: Ensure all medical and lifestyle disclosures are accurate to avoid disputes during this period.

4. Excluded Causes of Death

- Examples:

- Suicide Clause: Claims are denied if death occurs by suicide within the first two policy years.

- High-Risk Activities: Deaths caused during extreme sports may not be covered unless an additional rider is purchased.

5. Policy Beneficiary Issues

- What It Means: Incorrect or outdated beneficiary designations, such as naming a minor without a trustee.

- How to Avoid: Regularly update beneficiary information.

Debunking Common Myths

Myth 1: Life Insurance Always Pays Out, No Matter What

- Reality: Claims are denied for exclusions such as fraud, non-disclosure, or disallowed causes of death.

Myth 2: Pre-existing Conditions Automatically Void Policies

- Reality: Many policies cover stable pre-existing conditions if disclosed during application.

Myth 3: Any Family Member Can Claim the Payout

- Reality: Only named beneficiaries can receive the payout.

Myth 4: Insurers Look for Ways to Deny Claims

- Reality: Insurers are legally obligated to process legitimate claims quickly and fairly.

Advertisement

How to Prevent Claim Denials

1. Read the Policy Document Thoroughly

- Familiarize yourself with inclusions, exclusions, and specific clauses.

2. Provide Full Disclosure

- Honesty during application ensures a smooth claims process.

3. Update Beneficiary Information

- Regular updates prevent delays or disputes in payout.

4. Keep Your Policy Active

- Avoid lapses by ensuring premiums are paid on time.

5. Clarify Policy Riders

- Add riders for high-risk activities or specific coverage needs.

Key Questions Canadians Ask About Life Insurance Denials

Can a Policy Be Reinstated After Lapse?

Yes, many insurers allow reinstatement within a specific grace period, often requiring proof of insurability and payment of missed premiums.

Are Deaths During Illegal Activities Covered?

No, most policies exclude deaths caused by criminal acts or illegal activities.

How Long Do Beneficiaries Have to Claim a Policy?

There’s typically no time limit, but sooner is better to avoid complications.

What Happens If a Beneficiary Is a Minor?

Funds are held in trust or paid to a court-appointed guardian until the beneficiary reaches the age of majority.

Advertisement

Actionable Tips for Canadian Policyholders

- Review Policies Annually

- Ensure your policy reflects current life circumstances.

- Speak to a Licensed Insurance Advisor

- Get professional guidance to clarify terms and address concerns.

- Store Documentation Securely

- Keep copies of your policy where beneficiaries can easily access them.

- Communicate with Beneficiaries

- Inform them of the policy’s existence and coverage.

- Maintain Regular Contact with Your Insurer

- Notify them of life changes, such as health updates or address changes.

Conclusion

Understanding why life insurance claims might be denied helps Canadians make better decisions and avoid unnecessary complications. By staying informed, maintaining transparency, and regularly reviewing your policy, you ensure the financial protection of your loved ones is secure. Taking these proactive steps makes life insurance a reliable cornerstone of your financial planning.