Auto insurance isn’t just a legal requirement in Canada; it’s a financial safety net for you, your vehicle and others on the road. Whether you’re a first-time car owner or looking to update your policy, navigating auto insurance can be overwhelming. This guide will answer your questions, highlight the key points and help you get the right coverage for you.

What is Auto Insurance and Why is it Required in Canada?

Auto insurance in Canada is a contract between you and an insurance company. In exchange for a premium the insurer agrees to cover certain risks such as damage to your vehicle, liability for injuries or property damage you may cause. It’s required across Canada so all drivers can cover costs in the event of an accident.

Legal Requirements

Each province has its own set of mandatory coverages:

- Liability Insurance: Covers damage to others or their property.

- Accident Benefits: Covers medical and rehabilitation costs for you and your passengers.

- Uninsured Motorist Coverage: Covers you if you’re involved in an accident with an uninsured driver.

Advertisement

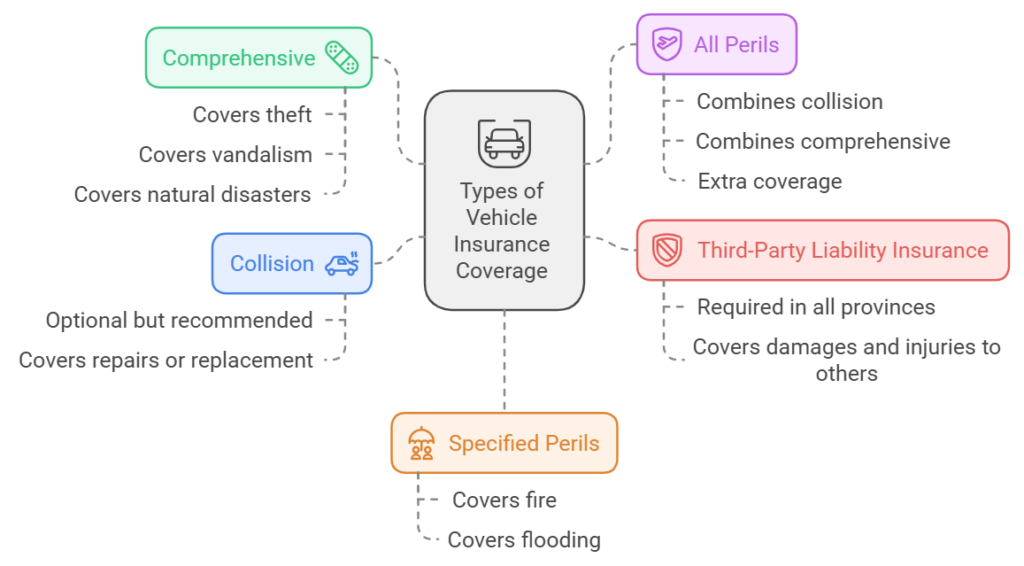

Types of Auto Insurance Coverage

Knowing the types of coverage is key to making informed decisions:

- Third-Party Liability Insurance:

- Required in all provinces.

- Covers damages and injuries to others.

- Collision:

- Covers repairs or replacement of your vehicle after a collision.

- Optional but recommended.

- Comprehensive:

- Covers non-collision incidents like theft, vandalism or natural disasters.

- Specified Perils:

- Covers risks listed in your policy, like fire or flooding.

- All Perils:

- Combines collision and comprehensive with extra coverage.

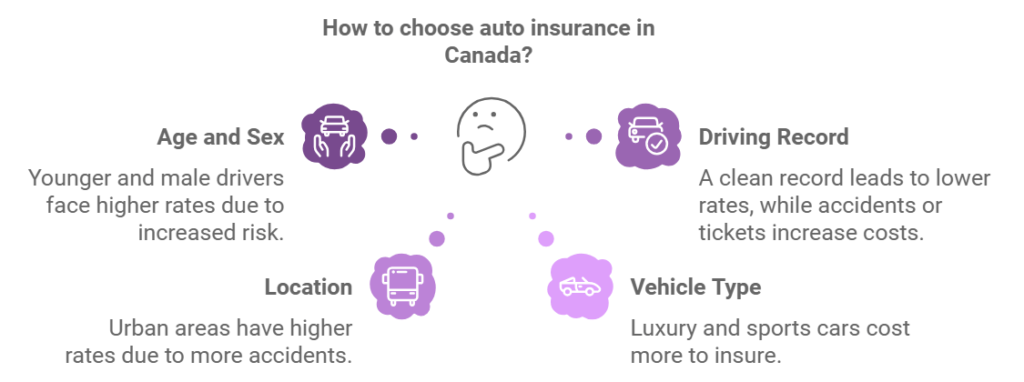

Factors That Affect Auto Insurance in Canada

Rates vary for:

- Age and Sex: Younger and males pay more because they are higher risk.

- Driving Record: Clean record = lower rates, accidents or tickets = higher rates.

- Location: Urban areas have higher rates because of higher accident risk.

- Vehicle: Luxury and sports cars cost more to insure than regular cars.

- Coverage: More coverage = higher rates.

- Deductible: Higher deductible = lower monthly premium.

Advertisement

Auto Insurance FAQs in Canada

1. How Do I Get the Cheapest Auto Insurance?

- Compare quotes from multiple companies using online tools.

- Bundle auto insurance with home or other policies for discounts.

- Keep a clean driving record.

- check for cars with low insurance. Some cars are high insurance because they get stolen more or are into accidents more. So check online for codes for car make model year to get an idea.

- Shop around and connect with different companies as you might get better rates and it could be useful to work with insurance brokers or aggregators.

- If someone in your household already has a car insurance, add yourself as a secondary driver on their insurance to start building your insurance history.

- Many insurance companies offer discounts if you download their app which tracks your car usage. So, make sure to get those apps.

- If you already have car insurance, shop around next year before your renewal and you could get a better deal from a different company. Check out my latest YouTube video on how to buy a car as a newcomer and subscribe for more tips like.

2. What Happens if I Drive Uninsured?

Driving uninsured is illegal and can result in big fines, license suspension and even jail time.

3. Does Auto Insurance Cover Rental Cars?

Many policies cover rental vehicles. But check with your provider to avoid rental company fees.

4. How Do Claims Work?

After an accident, contact your insurer with all the details, including police reports and photos. The claims adjuster will assess damages and facilitate payouts or repairs.

Tips to Get the Best Auto Insurance in Canada

- Shop Around:

- Even if you like your current provider, shop annually to see if you can get a better deal.

- Use Discounts:

- Look for discounts based on your age, occupation or memberships.

- Adjust Your Coverage:

- If you have an older car, consider dropping collision or comprehensive to save money.

- Telematics:

- Some companies have programs that track your driving and reward safe drivers with lower rates.

- Pay Yearly:

- Paying upfront avoids monthly installment fees.

Advertisement

Provincial Variations in Auto Insurance

Looking for auto insurance in Canada? There are many providers and brokers across the country. Here are some to consider:

- National Providers:

- Intact Insurance: Customizable coverage and discounts for safe drivers.

- Aviva Canada: Auto insurance products and flexible payment options.

- Desjardins Insurance: Great customer service and bundling discounts.

- Regional Providers:

- ICBC (BC): Government run insurer with basic and optional coverage.

- SGI Canada (Saskatchewan): Mandatory and additional coverage.

- MPI (Manitoba): Public insurance with add-on packages.

- Online Platforms:

- Rates.ca: Get quotes from multiple providers in minutes.

- Ratehub.ca: Simplifies the search for cheap policies.

- Insurance Brokers:

- Local brokers can help you navigate policies from multiple insurers and find the best for you.

- Ontario: Highest rates in the country due to high accident rates and fraud. Mandatory insurance includes additional accident benefits.

- Quebec: Lowest rates thanks to public auto insurance.

- Alberta: Rates have gone up recently and private insurers are the majority.

- British Columbia: Governed by ICBC, a public insurer with limited competition.

How to Save on Auto Insurance

- Know Your Policy:

- Read the fine print to avoid surprises.

- Good Credit:

- Many insurers use credit scores to calculate rates.

- Drive Well:

- No tickets and no accidents means lower rates.

- Ask for Loyalty Discounts:

- Long time customers can negotiate better rates.

- Talk to an Insurance Broker:

- Brokers can get you custom policies and better rates.

Advertisement

Drive Smart with the Right Insurance

Auto insurance in Canada isn’t one size fits all. Know the requirements, explore your choices and use the discounts to get a policy that’s right for you and your budget. Ask questions and talk to experts to make sure you’re covered. It’s not just a financial decision—it’s peace of mind.