Introduction

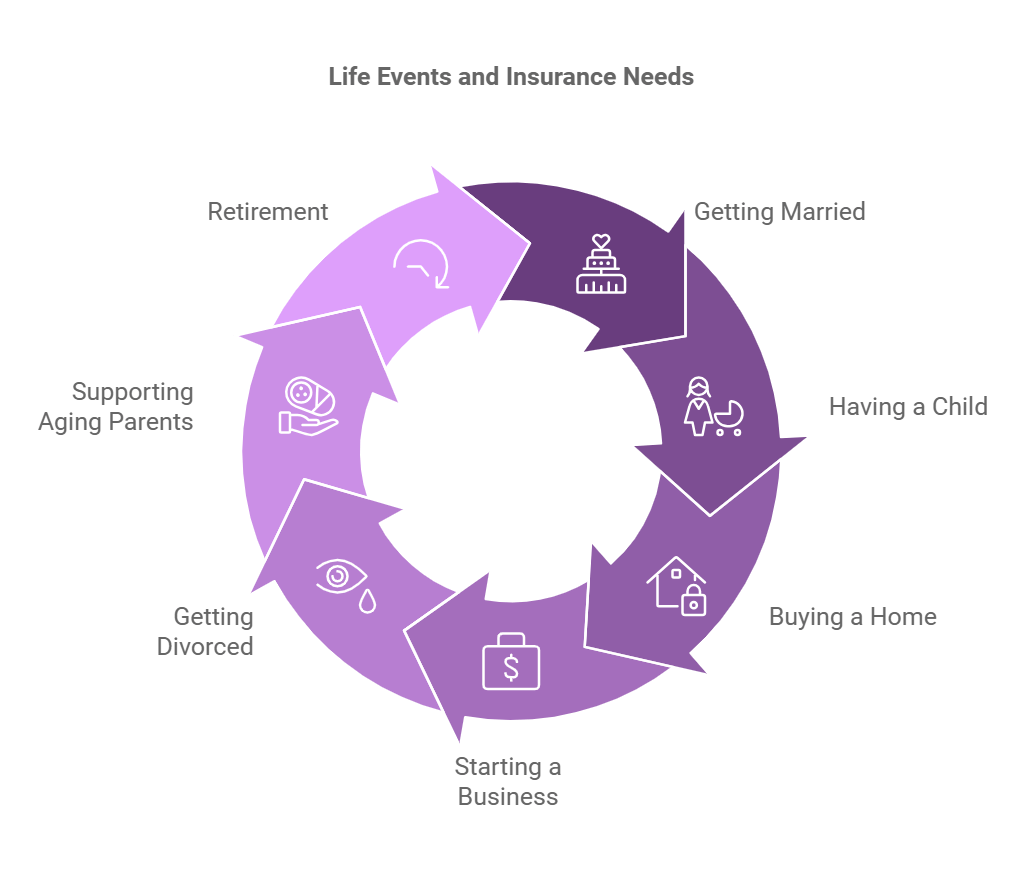

Life is full of surprises and certain life events make us stop and think about our responsibilities. Whether it’s starting a family, buying your dream home or planning for retirement, these life events remind us to think about our loved ones’ futures. Life insurance is one of the best tools to ensure financial security during life’s uncertainties. In this blog we will look at 7 life events that highlight the need for life insurance, answer your questions and provide practical tips to help you make informed decisions.

1. Getting Married: Protecting Your Partner

Marriage is more than a romantic promise; it’s a financial partnership. Combining incomes, managing expenses and planning for the future are all part of married life. A life insurance policy means your partner will have the financial means to pay off debts, daily expenses and future goals if something happens to you.

Key Point: A term life insurance policy that covers your combined financial responsibilities (e.g. mortgages, loans) gives you peace of mind.

Advertisement

2. Having a Child

When you first hold your child in your arms, their wellbeing becomes your number one priority. From education expenses to basic needs, raising a child is a long-term financial commitment. It can ensure your child’s needs are met even if you’re not around.

Stats: In Canada the cost of raising a child to age 18 is estimated to be over $250,000. It can cover that and more.

Tip: Look for policies that allow you to increase coverage as your family grows.

3. Buying a Home: Protecting Your Investment

Buying a home is often the biggest financial decision people make. Life insurance means your mortgage doesn’t become a burden on your family if you’re not around to contribute financially.

FAQs:

- Do I need a separate mortgage life insurance policy?

While mortgage insurance is an option, a term life insurance policy provides more coverage and flexibility.

4. Starting a Business: Protecting Your Business

Entrepreneurs take big financial risks to build their businesses. A life insurance policy can protect your business partners, employees and family by covering business debts and ensuring business continuity.

Tip: Key person insurance can cover the business if a key team member dies.

5. Getting Divorced: Reviewing Your Coverage

Divorce means financial adjustments – including changes to dependents or shared debts. Update your life insurance to reflect your new reality.

Insight: After divorce, review your beneficiary designations and make sure they match your current plans.

6. Supporting Aging Parents: Planning for Their Care

As your parents age their care becomes a financial burden. It lets you contribute to their needs without sacrificing your financial security.

Statistical Insight: According to Statistics Canada the cost of long term care for seniors can be over $20,000 a year. It can help offset that.

Advertisement

7. Retirement: Peace of Mind

As you approach retirement, life insurance can be a safety net for final expenses, outstanding debts or even estate planning. It’s also a way to leave a financial legacy for your loved ones.

Tip: Whole policies accumulate cash value which can give you more financial flexibility in retirement.

Life Insurance FAQs

- How much life insurance do I need?

10-12 times your annual income is a general rule of thumb but this varies based on debts, dependents and financial goals. - What’s the difference between term and whole life insurance?

- Term Life Insurance: Covers a specific period; lower premiums.

- Whole Life Insurance: Lifelong coverage and cash value.

- When should I get It?

The younger and healthier you are the lower your premiums.

Bottom Line

Life insurance isn’t just about planning for the unexpected – it’s about showing love and responsibility to those who depend on you. Whether you’re starting a new chapter in your life, building a legacy or securing your family’s financial security is a must. Take the time to review your needs, explore your options and talk to a trusted advisor to secure your future.

Advertisement