Saving 101

Before we dive into saving, we need to understand why it matters and how to do it right. Saving money isn’t just about cutting costs. It’s about building a foundation for financial security and future possibilities.

Setting Your Goals

The first step in any saving journey is to set clear goals. According to the Consumer Financial Protection Bureau, people with specific financial goals save 20% more than those without.

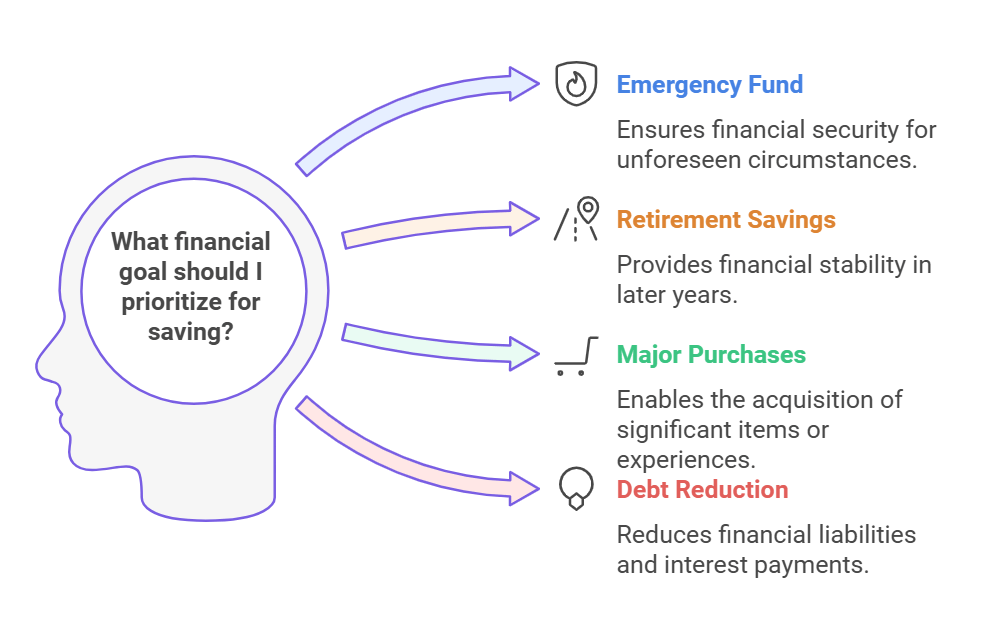

Consider these categories for your goals:

- Emergency fund (3-6 months of expenses)

- Retirement savings

- Major purchases

- Debt reduction

- Personal goals (travel, education, etc.)

Advertisement

How to Save Money

1. Create a Budget

Budgeting starts with saving. According to the National Foundation for Credit Counseling, 79% of people who budget feel more in control of their money.

50/30/20

- 50% for needs

- 30% for wants

- 20% for savings and debt repayment.

2. Bank Like a Pro

- Open a high-yield savings account (up to 5.25% APY).

- Use automatic transfers to save money.

- Minimize or eliminate bank fees.

3. Reduce Monthly Fixed Expenses

Housing

- If rates are good, refinance your mortgage.

- Negotiate your rent during lease renewal.

- House hack

Utilities

- Energy audit

- Smart thermostats

- Energy-efficient appliances

Insurance

- Bundle policies for discounts.

- Review annually.

- If possible, increase deductibles.

4. Shop Smart

Daily purchases

- Cashback credit cards

- Store loyalty programs

- 24-hour rule for discretionary spending

Major Purchases

- Research seasonal sales cycles.

- Negotiate prices on big-ticket items.

- CPO

Advertisement

Advanced Saving Techniques

1. Tax Planning

- Contribute to retirement accounts.

- Harvest losses in investment accounts.

- HSA

2. Debt

- Debt avalanche

- Debt consolidation

- Negotiate with creditors

3. Income

- Multiple income streams

- Request raises.

- Monetize your skills through side hustles.

Technology and Tools

Must-Have Apps and Services

- Budgeting apps (Mint, YNAB)

- Price comparison tools

- Automated saving apps

Building Wealth

1. Investment

- Max out 401(k) match

- Low-cost index funds

- Diversify portfolio

2. Education

- Stay updated on personal finance.

- Learn basic investing.

- Understand taxes

Advertisement

Don’t Do

- Lifestyle inflation

- Emotional spending

- Neglect emergency fund

- Overuse credit

Track and Adjust

Measure

- Savings rate

- Net worth

- Debt

- Returns

Conclusion

To save money successfully requires a combination of strategic planning, consistent execution, and regular evaluation of your methods. By implementing these strategies and maintaining focus on your financial goals, you can build a secure financial future while still enjoying life in the present.

External Resource Citations:

- Federal Reserve Economic Data (FRED) – [https://fred.stlouisfed.org/] Consumer

- Financial Protection Bureau – [https://www.consumerfinance.gov/]

- National Foundation for Credit Counseling – [https://www.nfcc.org/]